eFront editorial selection

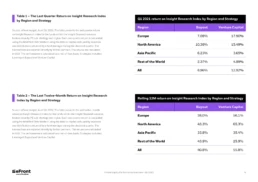

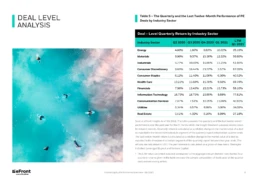

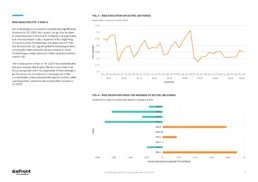

eFront report highlighting that secondary funds no longer provide significant upfront net capital deployment since 2013 due to distributions surpassing capital calls. The report also touches on the performance of active LBO funds in 2018 and the correlation between the amount of capital deployed in Year 1 and overall fund performance. Additionally, it emphasizes the challenges of deploying capital, LP-GP relationships, and the potential benefits of including distressed debt funds in a portfolio even during favorable macroeconomic conditions.

eFront editorial selection

eFront report highlighting that secondary funds no longer provide significant upfront net capital deployment since 2013 due to distributions surpassing capital calls. The report also touches on the performance of active LBO funds in 2018 and the correlation between the amount of capital deployed in Year 1 and overall fund performance. Additionally, it emphasizes the challenges of deploying capital, LP-GP relationships, and the potential benefits of including distressed debt funds in a portfolio even during favorable macroeconomic conditions.

Year2019ClienteFront, a part of BlackRock™ServicesEditorial, Data visualisation

eFront report highlighting that secondary funds no longer provide significant upfront net capital deployment since 2013 due to distributions surpassing capital calls. The report also touches on the performance of active LBO funds in 2018 and the correlation between the amount of capital deployed in Year 1 and overall fund performance. Additionally, it emphasizes the challenges of deploying capital, LP-GP relationships, and the potential benefits of including distressed debt funds in a portfolio even during favorable macroeconomic conditions.

Year2019ClienteFront, a part of BlackRock™ServicesEditorial, Data visualisation